Starting a business in Hyderabad, one of India’s fastestgrowing startup hubs, can be an exciting and rewarding journey. Among the various business structures available, registering a Private Limited Company (Pvt. Ltd.) is a popular choice due to its credibility, scalability, and ability to attract investors. If you are planning to incorporate your company in Hyderabad, this guide will walk you through the stepbystep registration process.

What is a Private Limited Company?

A Private Limited Company is a legal business entity registered under the Ministry of Corporate Affairs (MCA), governed by the Companies Act, 2013. It offers limited liability protection to its shareholders, separate legal identity, and easier access to funding.

Eligibility Criteria

Before beginning the registration process, ensure that your business meets the following basic requirements:

- Minimum of 2 directors and 2 shareholders

- It is mandatory to have at least one director who resides in India.

- Authorized capital of at least ₹1 lakh

- Unique company name approved by Ministry if Corporate Affairs

Step-by-Step Process to Register a Private Limited Company in Hyderabad

Step 1: Obtain Digital Signature Certificate (DSC)

- Each proposed director must have a Digital Signature Certificate (DSC) for signing electronic forms.

- It can be obtained from governmentapproved certifying authorities.

Step 2: Apply for Director Identification Number (DIN)

- Once you have the DSC, apply for Director Identification Number (DIN) through the MCA Portal.

- DIN is mandatory for anyone intending to become a company director.

Step 3: Reserve a Unique Company Name

- File the Name Reservation application (RUN form) on the MCA Portal.

- Choose a unique and meaningful name that complies with the naming guidelines and isn’t already taken.

Step 4: Draft Memorandum and Articles of Association (MoA & AoA)

- Draft the MoA and AoA defining the company’s objectives, rules, and internal structure.

- These documents are essential for incorporation.

Step 5: File Incorporation Application (SPICe+ Form)

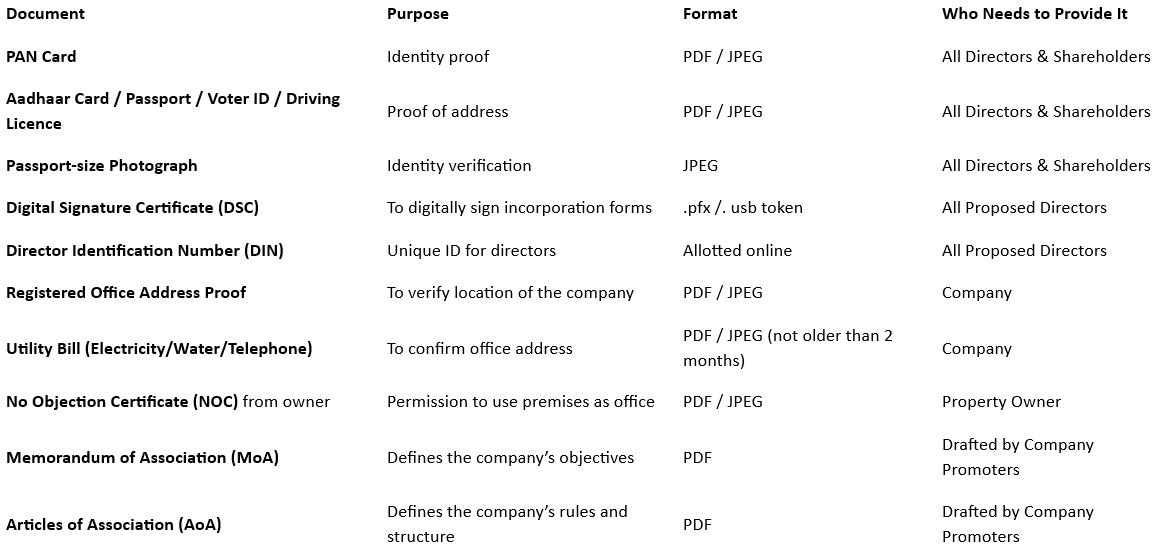

Submit the SPICe+ (INC32) form along with:

- MoA (INC33)

- AoA (INC34)

- PAN and Aadhar of directors

- Proof of registered office address

- Utility bills (not older than 2 months)

- Pay the prescribed registration fee and stamp duty.

Step 6: Obtain Certificate of Incorporation

- Once documents are verified, the Registrar of Companies (ROC) will issue a Certificate of Incorporation (COI).

- This certificate contains your company’s Corporate Identity Number (CIN) and marks the legal birth of your company.

Post Incorporation Compliances

After incorporation, complete these essential formalities:

- Apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN).

- Set up a current account under the company’s name.

- Register for Goods & Services Tax (GST) if applicable.

- Maintain statutory registers, records, and file annual returns regularly.