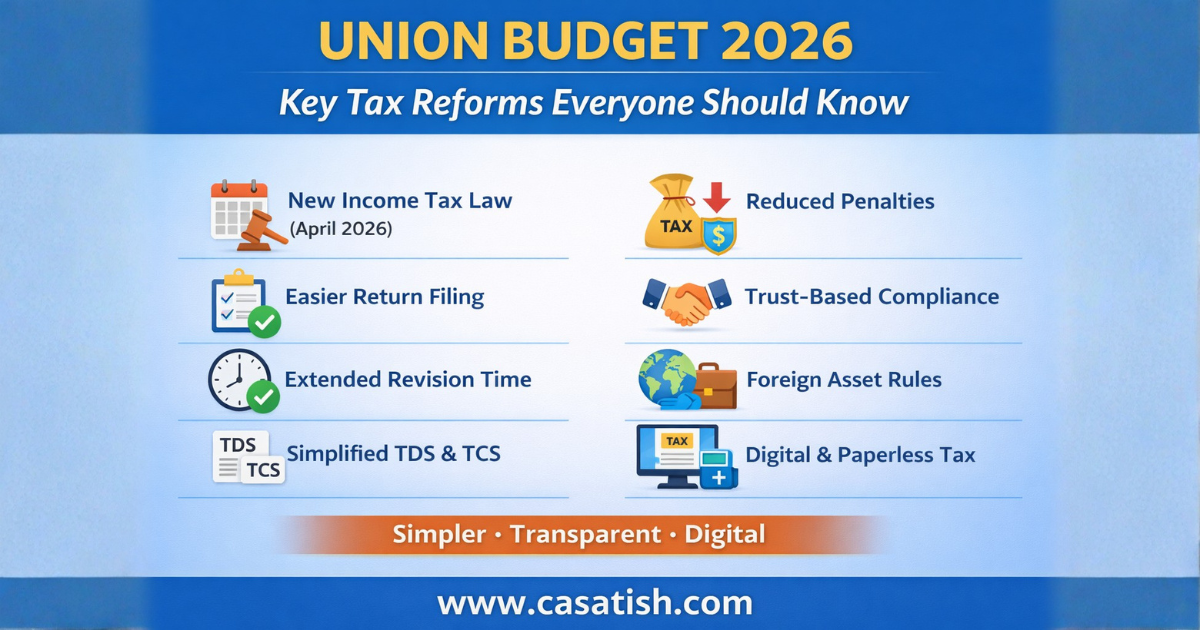

The Union Budget 2026 introduces a series of reforms aimed at making taxation simpler, compliance easier, and the overall system more transparent. The focus is on reducing complexity, encouraging voluntary compliance, and using technology to improve efficiency. Below is a clear overview of the most important reforms that affect individuals, businesses, and investors.

1. New Income-Tax Law from April 2026

A new income-tax law will come into effect from 1 April 2026. While tax rates remain largely stable, the structure of the law has been rewritten in simpler language with clearer provisions. The goal is to remove outdated sections, reduce confusion, and make tax rules easier to understand.

What this means:

Taxpayers can expect better clarity, fewer disputes, and more predictable outcomes.

2. Easier Income-Tax Return Filing

Income-tax return forms are being simplified with fewer complicated schedules and more pre-filled information. The process is designed to reduce errors and make filing more user-friendly.

What this means:

Filing returns becomes quicker and less stressful, especially for individuals and small businesses.

3. More Time to Correct Mistakes

The time limit for revising income-tax returns has been extended. This allows taxpayers to correct genuine mistakes or omissions without immediately facing penalties.

What this means:

Greater flexibility and peace of mind when filing returns.

4. Simplified TDS and TCS Rules

The Budget rationalises tax deduction and collection provisions to reduce unnecessary deductions and improve cash flow. Thresholds and procedures have been streamlined.

What this means:

Less money gets blocked due to excess deductions and compliance becomes smoother.

5. Reduced Penalties and Litigation

The government is moving towards fewer penalties and less litigation. In many cases, monetary adjustments will replace harsh penalties, and multiple proceedings for the same issue will be avoided.

What this means:

Faster resolution of tax matters and lower legal burden.

6. Shift to Trust-Based Compliance

Minor and technical defaults are being treated with a more lenient approach. The focus is on encouraging honest reporting rather than punishment for small mistakes.

What this means:

A friendlier tax environment that rewards voluntary compliance.

7. Fully Digital Tax Processes

Tax administration will continue to move towards paperless and faceless systems. Certificates, approvals, and communications will be issued digitally.

What this means:

Less paperwork, fewer physical visits, and faster processing.

8. Clearer Rules for Foreign Assets and Income

Reporting requirements for foreign assets and overseas income have been simplified and clarified. Taxpayers are given better guidance and opportunities to regularise disclosures.

What this means:

Improved certainty for people with international income or investments.

9. Stronger Reporting for Property and Digital Assets

Transactions involving immovable property and digital assets such as virtual currencies will have stricter reporting norms. The system will rely more on data matching and automated checks.

What this means:

Accurate reporting becomes more important to avoid notices or mismatches.

10. Changes Affecting Investors and Businesses

Updates related to securities transactions, share buybacks, and corporate taxation will influence financial planning and reporting. These changes encourage transparency and long-term compliance.

What this means:

Investors and businesses should review their tax strategies carefully.

11. Technology-Driven Tax System

The Budget reinforces the use of technology, automation, and data analytics to improve efficiency and transparency in the tax system.

What this means:

Faster processing, fewer errors, and improved trust in the system.

Final Takeaway

Union Budget 2026 focuses on:

- Simpler tax laws

- Easier compliance

- Reduced penalties and disputes

- Greater use of digital systems

- A trust-based approach to taxation

These reforms aim to make the tax system more transparent, predictable, and taxpayer-friendly in the long run.